Why is Research Discovery Important?

2nd November 2023

Oliver Hunt | Chief Product Officer at Limeglass Ltd | oliver.hunt@limeglass.com

Hamish Risk | Head of Research Discovery at Substantive Research | hamish@substantiveresearch.com

Problem

Producing research generally takes at least 50% of a Sell Side analyst team’s time. Investors, however, read less than 10% of the research they receive. Analysts tend to get rewarded for meetings rather than for their written product, so those economics are not as bad as they first appear, but still have significant room for improvement.

Research Discovery is the way to improve these economics for both Sell Side and Buy Side.

The situation is particularly acute at the moment as research budgets continue to shrink. The latest Buy Side survey from Substantive Research shows that average budgets have decreased a further 6.5% and that payments to the top ten brokers increased to 54.6% (from 53.9% in 2022).

MIFID II’s unbundling of research payments from trading revenue might soon be reversed in the UK, but it has shone a harsh light on research economics globally. It has shown how hard it is to measure the relationship between an analyst’s written content and the content’s impact on an investor’s performance. And if it is hard to measure, it is hard to value.

All this means a poor ROI on research production for the Sell Side. Clients are paying very little for the costs of creation, no matter how much work the analyst has put into the product, nor how impactful its insights might be.

It also means a poor ROI on the research budget for the Buy Side (no matter how large or small that budget is in absolute terms). Again, there may be plenty of value buried somewhere in the content, but if investors cannot find it, the money is wasted.

Revolutionising Research Discovery, therefore, is crucial for both Buy and Sell Side to solve these problems. A good discovery solution will increase the impact that all written content can make on its intended consumers. The content becomes more relevant to more clients, more frequently, and more rapidly.

How are clients using or hoping to use Research Discovery?

In our previous article, we suggested that, although Research Discovery has become a hot topic because of the recent advances in Large Language Models (LLMs) and related technologies, most real use cases can be achieved with other new and existing (and certainly less “black-boxy”) approaches.

In this article, we lay out how our two firms do just that. Limeglass as the technological enabler of all imaginable discovery solutions; and Substantive Research as the Super User, providing a dedicated bespoke hybrid discovery service.

Let’s look at these two approaches in more detail.

Limeglass: The Enabler of All Discovery Solutions

Limeglass breaks Research Discovery down into three major categories based on existing and expected future use by clients: Active Discovery, Passive Discovery, and Analytics.

Active Discovery is where the investor clients, or Salespeople on their behalf, are able to find specific Research insights for their investment processes. This can be done in many ways, the most powerful of which is through Smart Search or dedicated browsing systems like the Limeglass Portal. Searching heterogeneous, complex content like Investment Research is done very poorly across the industry at the moment, but doing it well can unlock enormous value.

We will write more about this in our next article where Limeglass CTO Simon Gregory delves into the technological challenges in this space, warns that Large Language Models are only a small part of the solution, and introduces the proprietary search solution that Limeglass has developed.

Passive Discovery is the opposite, where Research consumers are provided with tools capable of showing them or alerting them to content they did not necessarily know they needed to read.

This has long been an unmet need for the consumers of research. The producers tend to have distribution systems that make it difficult to target the correct content at the correct consumers. This is one of the main reasons that so much research languishes unread in people’s inboxes.

For example, at the moment it is easy for the Sell Side to set up distribution lists for a certain analyst’s reports, or for a certain asset class or sector, but it is extremely difficult for them to identify and distribute documents relevant to broad themes like Artificial Intelligence or the Energy Transition.

Analytics is the final piece. We will discuss later how content can only be truly discoverable when it is turned into rich data. With this rich data, Quants can analyse previously inaccessible trends buried in the text, the Sell Side can optimise complex research workflows, and the Buy Side can assess the relative value of the content it is paying for.

Ultimately, there is no limit to how this data can be used, but certain emerging use cases in this space are gaining traction: Quant teams are looking at the co-occurrence of certain ideas within the research, inferring interesting hypotheses about the informational value of Sell Side content; Sell Side management teams can compare readership data for their documents versus the rich tag data and see where they should be investing more or less heavily in their research coverage; the Sell Side is also improving complex manual workflows like the Supervisory Analyst and Compliance reviews of research; and the Buy Side can get a granular view of exactly what their providers are writing about and which providers best fit their requirements.

Substantive Research: The Super User

Substantive Research, meanwhile, has been delivering a bespoke research discovery service to the buy side for almost a decade. The premise is quite straightforward.

“Mr and Mrs Portfolio Managers, you are time poor, so let us be your window to the wider research market. We’ll point you to quality research you may be missing, and we’ll also help you find the research providers that are a good fit for you. We’ll even help you save money in the process.”

By definition, that’s made the company a ‘’super user’’ of investment research, with its large network of independent and Sell Side research firms providing an opportunity to showcase their research product to help build brand awareness and grow their respective client bases. The model is agnostic, in other words, it focuses on identifying quality research across hundreds of research suppliers, rather than focussing on one specific research provider.

That said, the model is by its very nature symbiotic. Research producers get to showcase their strengths, while consumers get to optimise their research inputs through the discovery of better quality research. An essential element of the procurement process.

How do both companies enable this?

Limeglass: Transform unstructured research into structured dataThe key is to transform unstructured research documents into rich, structured data. This process is performed by the underlying Limeglass technologies:

- Research Atomisation™ breaks up documents into constituent paragraphs and allows those “atoms” to be accessed individually

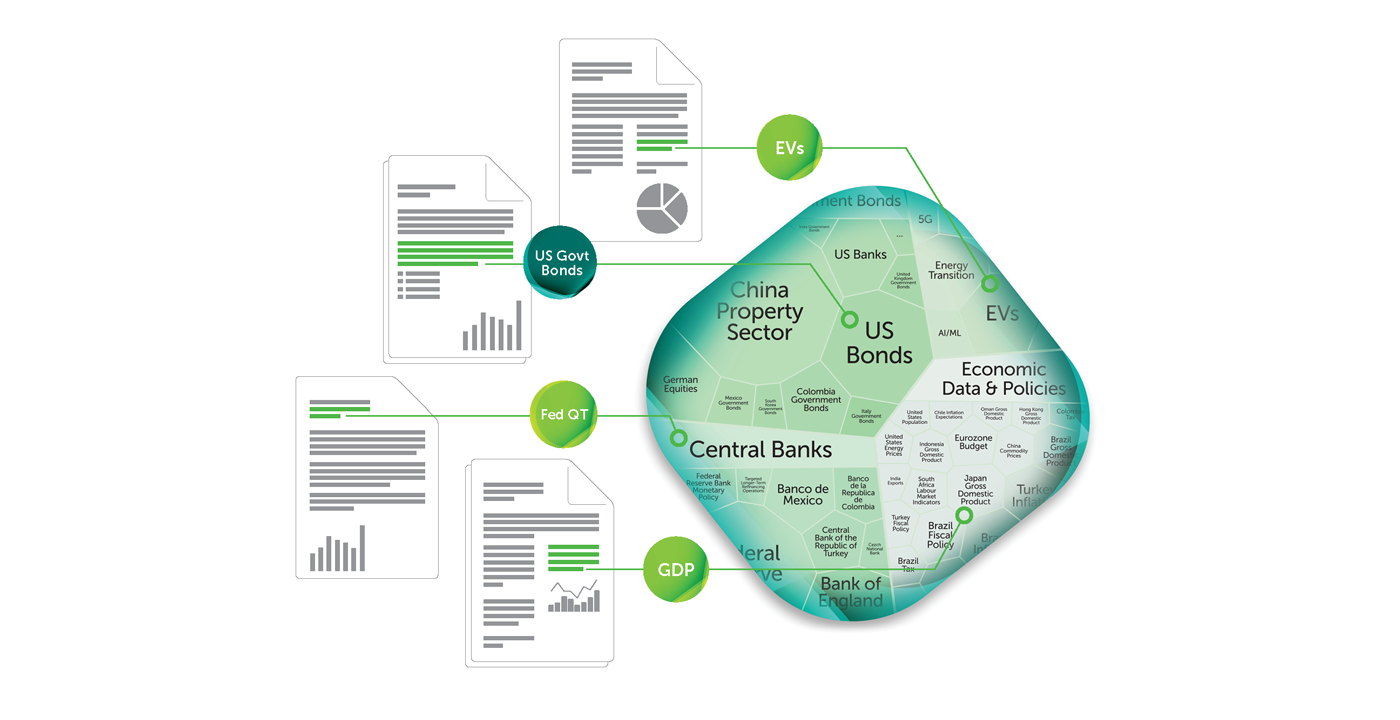

- Rich-NLP uses the Limeglass Knowledge Graph to tag the individual paragraphs in their context

Only when this has been done, can that data be made available over APIs or through various tools to enable all the different use cases.

How Limeglass transforms unstructured research into structured data

Limeglass identifies the individual paragraphs in a document, tags those paragraphs, and stores that information in a rich dataset. The paragraphs are indexed against the tags and the document IDs, enabling ground-breaking research discovery through Active, Passive, or Analytical methods.

Example

Imagine you’re an equity investor trying to find research about something shortly before heading into a company meeting. You don’t have much time and you’re about to sit down with the CEO of an engineering firm that has just announced the rollout of a new suite of IoT sensors. You want to know if any of the Sell Side analysts covering this company have made an initial assessment of the valuation impact that the IoT rollout might have for the stock. You’re also interested in reading a few highlights about other companies and industries involved in IoT as you have not looked at that space for a while.

If you have access to a system using the core Limeglass technologies, you would be able to search or browse for this research (if it exists!) with ease. All it would take is to look for paragraphs tagged with “IoT” and paragraphs tagged with “Valuation” inside documents tagged against the company’s name. And, even more simply, you could then look across other sectors and companies for the most relevant mentions of IoT to give you more context.

Substantive Research: Human experts using the best tools

Substantive Research’s approach to research discovery is a hybrid model, harnessing technology with a human overlay. In their view, research discovery is a nuanced process. Portfolio managers have different tastes, and they use research in different ways, and so quite often, ‘beauty is in the eye of the beholder.’ That requires Substantive to adapt its own filtering and discovery process to suit these different use cases, working directly with individual clients to understand the nature of their query.

The Human Aspect

This isn’t just about filtering by a topic, and seeing what results come back. It’s much more granular than that, using human expertise to interpret the portfolio manager’s question and then narrowing down the search to specific topics, and text. Research discovery is not a ‘one size fits all’.

Examples

“I’m bullish equities, so please show me only bearish pieces. I want to test my own thesis.”

“Can you show me research that covers investment opportunities right across different parts of the AI value chain (Hardware, software etc)?”

“I want to understand where we are in the investment cycle, please show me research that details different indicators for where we are.”

“Can you show me research that is most out of consensus, who are the outliers, both bullish and bearish. I’m only interested in research that has detailed analysis that backs their view?”

“Can you compile research that looks across important leading indicators?”

The key point to make from the above examples is that conventional ‘search’ in the research space today isn’t designed for such bespoke enquiries. That’s why the whole process of research discovery is so time consuming. Substantive set themselves up to take that hassle away from the time poor portfolio manager. Yet they knew they needed a tech solution in order to become more productive and scale their process.

The Technology Aspect

This is where Limeglass’s technology comes into play. Substantive accesses the research in its atomised form via the Limeglass Portal, taking advantage of the rich dataset of tags and metrics. This means that key text can be found at a paragraph level within the reports to find answers to client questions. From there, Substantive’s curation team shortlists the most relevant notes, checks the robustness of the analysis, and then creates a curation of the ‘must read’ pieces for the client.

Up next

In our next joint article, Hamish will be talking to Limeglass CTO and Co-Founder Simon Gregory about why the approach to Research Discovery taken by Limeglass and Substantive is so valuable. He will give us the technical perspective on the difficulties in dealing with a unique, highly regulated product like Investment Research, how most current approaches to this are flawed, and how best to approach it (including everything you need to do before even thinking about incorporating Large Language Models into the process)!

News & Insights

Limeglass Ltd is a Fintech providing Research Discovery services to producers and consumers of Investment Research across the Buy Side and Sell Side. Limeglass combines the power of AI & human domain expertise to turn unstructured research documents into rich, structured data, unlocking a variety of use cases to improve the utilisation of content for consumers and the production ROI for producers.

Substantive Research offers independent comparison and discovery on investment research, ESG and market data pricing and products. Substantive’s Research Discovery tool is designed to be an investor’s window to the investment research market, matching them to providers’ that best suit their investment process requirements.

This article was co-authored by Hamish Risk at Substantive Research & Oliver Hunt at Limeglass Ltd.