Cutting through the January Research deluge

Institutional salespeople know that making an early impact in January is crucial. If you can be impactful while portfolio managers are resetting their positions, you are well poised to capture a significant share of their business. But it is hard to cut through at a time when everyone is deluging clients with ideas.

You must make sense of thousands of pages of recently published Research Outlook reports. Now is the time to find the key research insights that will help you craft the strongest, most attention-worthy messages and sell your value-added investment strategies for the year ahead.

This is hard work at the best of times, and in 2023 your clients are working to recover from one of the toughest years for investment professionals. Risk was repriced and consensus on the oil and gas prices discarded, and the markets have not yet arrived at a new consensus on key numbers – whether the yield curve, inflation break-evens, dividend yields, or euro/dollar.

As 2023 began, it would have been appealing to focus on helping clients plan a return to risk assets later in the year. But how are you meant to concentrate on making your pitch convincing when, all of a sudden, the Bank of Japan confuses everyone with its Yield Curve Control announcement. Are they tightening or not? What should we expect from Japanese yields and the yen as a result?

Thank goodness for Limeglass.

Using our proprietary Financial Ontology and Rich NLP, we can process and tag all of your firm’s research at paragraph-level. We then make these tagged paragraphs available in a way that suits you, so that you can search for and consume only the key research insights you need. Suddenly, the volume of reports becomes an asset, not a time-sink.

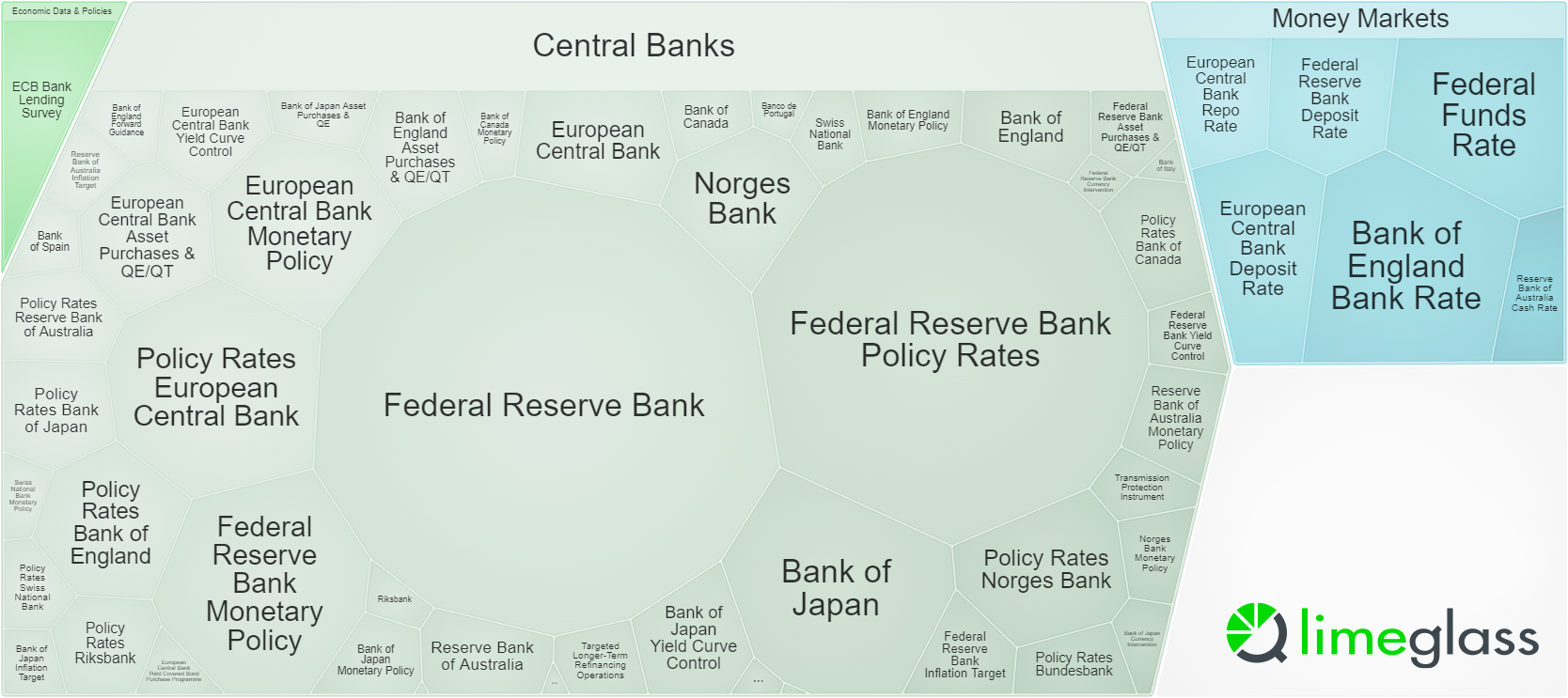

One of our most popular products is a Heatmap visualisation of recently trending topics which have been mentioned in research reports. You could access this heatmap either on your company’s intranet or receive it as an email.

If you think concerns over monetary tightening in Japan are overdone and seek opportunities for a reversal, you do not have to read every single report published by your Rates and Macro teams. Simply click on the heatmap where it says “Bank of Japan” or, even more helpfully, “Bank of Japan Yield Curve Control”.

Limeglass can set things up so that the mouse-click either takes you to a curated list of the relevant reports on your company’s portal, or even to a relevant compilation of paragraphs – the pinnacle of research-consumption efficiency!

Oliver Hunt

Head of Client Solutions